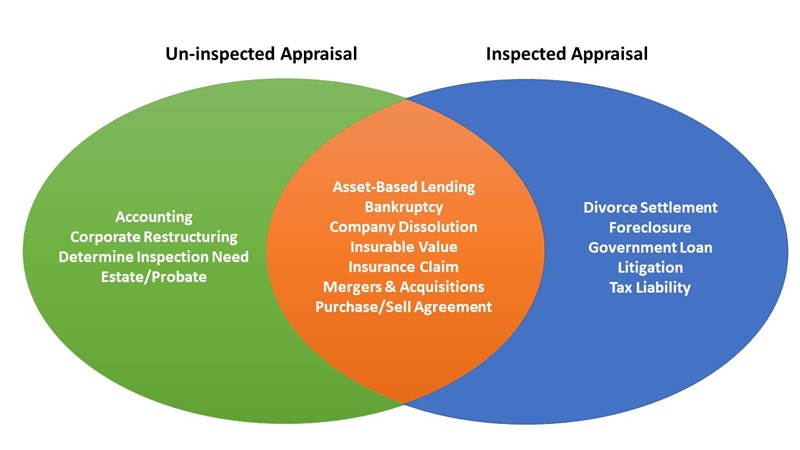

Recent updates to USPAP have changed the definitions of appraisals. Many people are familiar with the recently antiquated term Desktop Appraisal. Now there are really two types of appraisals. Either an Un-Inspected Appraisal or an Inspected Appraisal.

The purpose and intended use of the appraisal determines whether an inspection needs to occur. The ultimate deciding factor for inspection is if a credible report can be determined without the inspection.

Un-inspected Appraisals are usually used for internal accounting purposes for things such as corporate restructuring, determining if an onsite inspected appraisal is needed or if you are doing asset allocations.

Inspected Appraisals are usually required for divorce settlements, foreclosures, government (SBA) loans, litigation and tax Liability. Inspections are required wherever you want to make sure that your appraisal can withstand intense scrutiny.

Sometimes an appraisal can be either inspected or un-inspected as determined by many factors related to the user and use. If an appraisal was recently completed with an inspection and little has changed, then an un-inspected appraisal may be appropriate. Asset-Based Lending, Bankruptcy, Company Dissolution, Insurable Value, Insurance Claims, Mergers and Acquisitions and Purchase/Sell Agreements all fall in the category of appraisals that can be inspected or un-inspected.

If you're ready to get started on a machinery and equipment appraisal and would like to know more, please contact our office and our appraiser can walk you through the process.